Designed for Every Situation

Taxu adapts to your unique tax situation

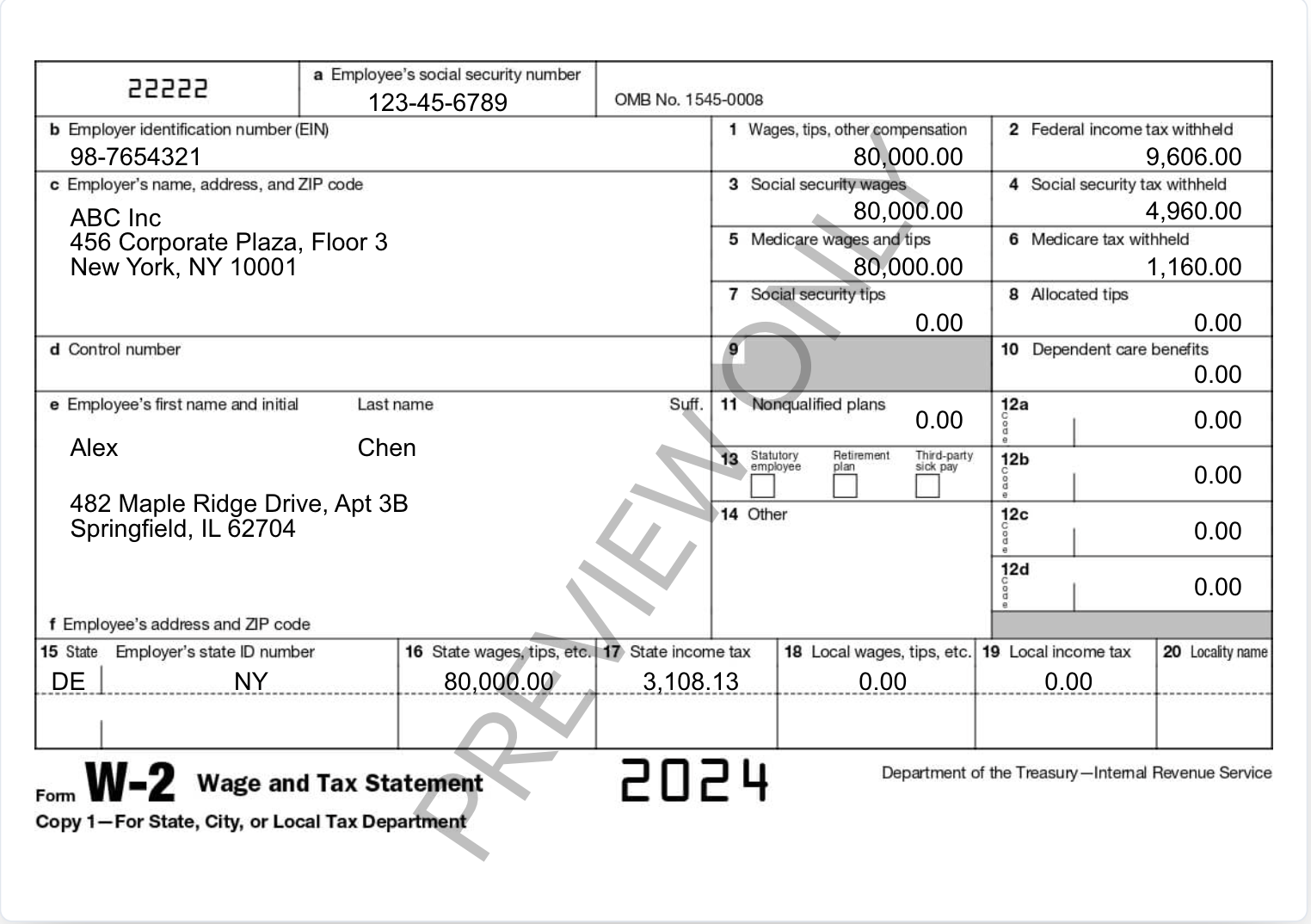

W-2 Employees

Simple filing for salaried workers

- Upload W-2 and file in minutes

- Standard deduction optimization

- Multi-state support

- Dependent management

Students

Education credits and deductions

- 1098-T form support

- Student loan interest deduction

- Education credit maximization

- Part-time job income handling

Gig Workers

For Uber, DoorDash, freelancers

- 1099 income tracking

- Mileage deduction calculator

- Quarterly tax estimates

- Self-employment tax optimization

Side Hustlers

W-2 plus freelance income

- Combined W-2 and 1099 filing

- Home office deduction

- Equipment depreciation

- Estimated tax payment planning

Everything You Need

One platform, all your tax needs covered

Free for simple returns (W-2 only)

Premium filing for $29 (includes state)

Unlimited amendments at no extra cost

7-year document storage

Maximum refund guarantee

Audit support included

Upload and Go

No complicated forms. No confusing questions. Just upload your documents and let Taxu's AI handle the rest.

- Instant Document ScanningAI reads your W-2, 1099s, and other forms in seconds

- Smart Deduction FinderAI suggests deductions based on your situation and industry

- Real-Time Refund TrackingWatch your refund estimate update as you add information